Table of contents

Pitchbook releases preliminary data on venture capital investments worldwide, here is the analysis for Europe with a comparison to the rest of the world and the US market.

Europe

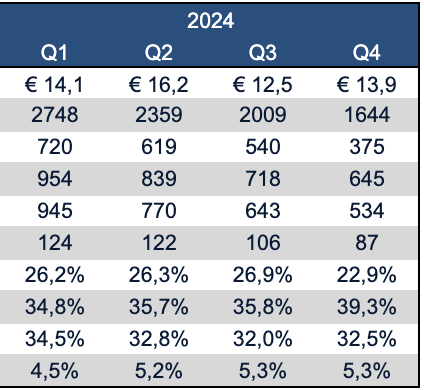

In 2024, the value of venture capital investments in Europe declined slightly from EUR 61.6 billion to EUR 56.7 billion, while the number of transactions decreased by around 16% year-on-year, from 11410 to 8760 (to which analysts estimate a further 859 could be added for an estimated total of 9619, a figure that we will return to at the end of January when the final report is published), due to a more cautious general environment that characterised last year’s activities. ‘Deal activity in Europe declined across all early-stage financing, in most verticals and in several regions, due to the tightening of the financing market,’ says Nalin Patel, analyst at Pitchbook. The share of pre-seed and seed investments stood at 25.8%, while early-stage and later-stage investments accounted for 36.1% and 33.1% respectively; only 5% was the share of venture growth rounds.

Artificial intelligence drove just over a quarter of deal value in 2024, recording a total deal value of EUR 14.6 billion. “Large deals attributable to other venture markets did not materialise to the same extent in Europe, keeping the proportion of deal value in line with the deal count standing at 2039,” Patel adds.

The value of exits increased in 2024, otherwise it was a rather quiet year for European venture capital companies, particularly on the listing front, as companies avoided exits. “We expect exits to pick up in 2025, when market conditions improve,” confirms the Pitchbook analyst.

In 2024, the capital raised by European-based venture capital funds remained largely unchanged from the previous year, EUR 20.5 billion compared to EUR 20.8 billion in 2023, and was below the peak reached in 2022 when it reached EUR 34 billion. The number of funds also decreased in 2024, falling by about a fifth compared to 2023, from 219 to 173 (it was 483 in 2022). The decline in the number of funds and the capital-raising figures indicate that fewer but larger funds were closed in 2024.

Among the major deals recorded during 2024 Pitchbook mentions the British GreenScale, Wayve, Abound and Monzo, the French Mistral AI, Poolside and Voodoo, the German Helsing and Picnic based in the Netherlands. Among the exits were Spain’s Puig and the UK’s EyeBio, Rezolve AI.

World

Globally, the value of investments has reached $368.5 billion and the number of deals is close to 40,000.

The Asia Pacific (APAC) business market has struggled in recent years, which has not changed in 2024. Compared to Europe and the US, the amount of dry powder accumulated within the various APAC markets has been much smaller, which has put further pressure on dealmaking over the past year. China, which drove about half of APAC’s annual deal activity, experienced a substantial drop in activity, due to both the country’s economic challenges and tensions with the US government, which limited the activity of US-based companies. Only 20.4% of the transactions took place in Asia, the lowest percentage in the last decade.

“Globally, artificial intelligence has continued to dominate the headlines and investors’ attention, despite the fact that some have observed that the investment business is not sustainable in the long term. Whether this is true or not is trivial at the present time. Just over half of all venture capital invested globally in the fourth quarter went to an AI-focused company. While it is true that this figure was heavily influenced by companies such as OpenAI, Databricks, xAI and other well-known companies making share buybacks and investments in chips and computing power, the more important factor is the level of capital availability for AI compared to other sectors. Over the past two years, the percentage of overall deals going to AI companies has steadily increased as large companies and investors are moving to take advantage of the efficiencies expected from the next wave of technology,’ explain analysts Patel and Kyle Stanford.

VC-backed exits have not historically been strong for APAC, although many markets are still too young to develop a healthy exit environment. The lack of exits in many regions has made many foreign investors wary of increased activity during the market slowdown. Japan was an exception in terms of counting, as many IPOs within the country contributed to higher returns for investors. In 2024, 19% of VC-backed exits globally will originate in Asian companies.

Fundraising was slow globally, with new commitments falling just over 20% year-on-year. The lack of exits had a strong impact on fundraising in Asia, as LPs were less likely to renew commitments during this period. 2024 marked the lowest year for new commitments since 2018 and was the lowest year for closed-end funds in the market in the past decade. North America and Europe also struggled to secure new commitments for venture funds.

United States

As far as the US is concerned, the total value of VC investments in 2024 is $209bn with a deal count of over 15,000. Kyle Stanford comments, “Deals remained relatively robust in 2024 from a counting perspective and increased slightly (3.7%) year-on-year . This seems counterintuitive to the market narrative of recent years, but it is indicative of the retention of some of the venture mechanics of a few years ago. What has happened is that the excess dry powder from the high fundraising years of 2021 and 2022 has kept many investors active in the market despite the lack of returns. With the slow fundraising years of 2023 and 2024, it is likely that this relative strength will begin to deteriorate as funds run out of available capital and are unable to raise another fund.”

Artificial intelligence continues to be the story of the market and has driven almost all VC funding in 2024. OpenAI, xAI, Anthropic and others have become synonymous with larger-than-life venture operations, and appear to operate in a different funding environment than most VC-backed companies, which continue to struggle with less available capital.

The lack of exits remains the story of the venture market, even if the outlook is brighter. Just $149.2 billion in exit value was created in 2024, largely from a handful of IPOs. The unicorns, which hold about 2/3 of the value of the venture capital market in the US, have maintained themselves as private companies, creating pressure on investors and LPs due to the lack of distributions. Mergers and acquisitions also remained muted in 2024, with few major deals. A more takeover-friendly environment in 2025 could set the stage for a renewed M&A market, especially if a soft landing for the economy can be built.

“Fundraising was dominated by large, established companies. 30 companies accounted for more than 68% of the total value of fundraising in 2024 . This is a trend that has developed over the past few years, but peaked last year. Many of the emerging managers who raised funds during the VC market boom in the ZIRP (zero interest-rate policy, ed) era were unable to generate returns and their portfolios suffered from the valuation changes that occurred during the market change. Without a track record, many companies find themselves in a very difficult market to raise new funds from LPs,’ Stanford concludes.

ALL RIGHTS RESERVED ©