European Equity Crowdfunding Landscape is the first report analysing and mapping the European equity crowdfunding market for start-ups and innovative growth companies. It was produced by Over Ventures in collaboration with Italian Tech Alliance, and provides a structured view of the European landscape, highlighting the performance of equity crowdfunding campaigns in 2024 and analysing the current and future opportunities created by the entry into force of the EU Regulation 2020/1503 (ECSPR) on 10 November 2023.

“This report represents the first real analysis of the market at a European level, and we want it to become a useful tool for entrepreneurs, platforms and investors to understand the potential and benefits that crowdfunding can provide,’ Giancarlo Vergine, founding partner of Over Ventures, tells Startupbusiness. ‘Today I think we have seen some very interesting data for our country in this market. In fact, Italy is surprisingly the second largest crowdfunding market in Europe, after France, which compared to the sixth/seventh place we have in the venture capital market is really positive. At the same time, given that the Italian platforms are mainly concentrated in Italy and that there are not many active international operators, the future objective must be to continue in this direction by seeking more and more collaboration within the venture capital chain. Data in hand, I believe there is still plenty of room for growth’.

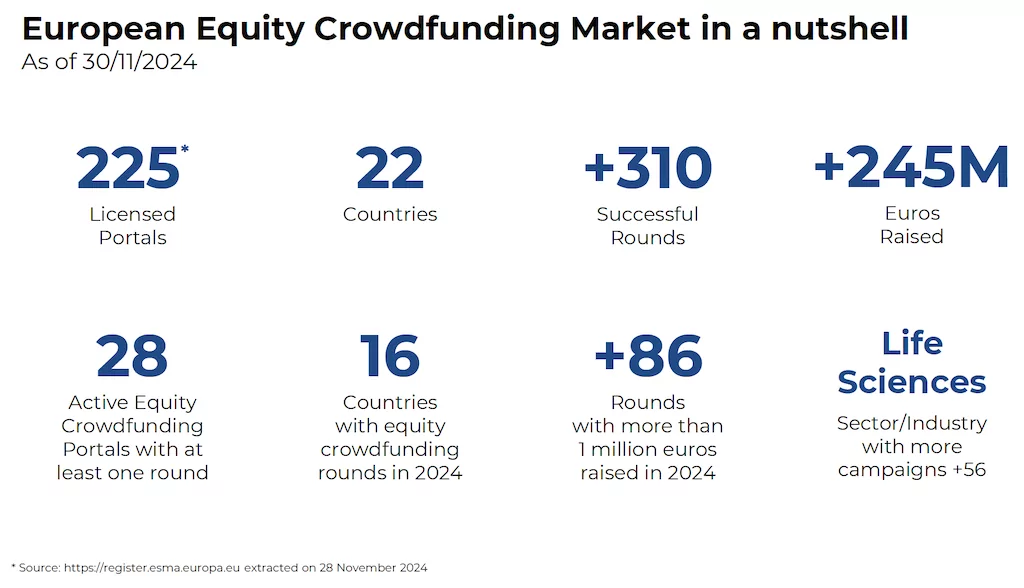

The report, which is based on contributions from the main platforms and some of the continent’s leading market experts, analyses over 310 successful equity crowdfunding campaigns launched during the year by the main authorised platforms and over 245 million euro raised. Although the ECSPR Regulation has opened up the continental market for more than a year now, only 54 of the 225 portals authorised by ESMA focus on equity crowdfunding for start-ups and SMEs, and thus more akin to the venture capital and private equity market, leaving the others with the ever-growing fundraising activity in the lending, real estate and green energy sectors, which are excluded from the analysis. France confirmed its position as European leader both in terms of the number of authorised portals, with 59 in total and 15 active in equity for start-ups and SMEs, and in terms of capital raised, over EUR 77 million. Italy follows in second position, with over EUR 52 million raised platforms such as Mamacrowd, Europe’s second largest platform in terms of capital raised, and CrowdFundMe, despite the limited presence of regional operators (Crowdcube, Republic Europe and Invesdor) compared to France, where these have consolidated. On the other hand, Germany, with only five authorised crowd investing platforms, none of which operate in equity crowdfunding for start-ups and SMEs, only raises a few funds thanks to the support of international operators.

Among the sectors that led the market in 2024 were life science, food & beverage and lifestyle. In terms of performance, campaigns such as that of Baladin, which raised €5m from 2,196 investors, reaching the maximum limit set by the ECSP Regulation for Italian portals, and that of the French fintech Green Got, which with €5.3m raised from over 3,700 investors on Crowdcube recorded the highest collection of the year thanks to its licence to also operate in the UK, where the maximum limit is €8m. Also noteworthy is the community funding to complement the VC funding by the French unicorn Vestiaire Collective, with over 3.5 million euros raised by more than 3,200 of its users also on Crowdcube.

The presentation of the report was attended by key players in the Italian ecosystem: in addition to Giancarlo Vergine himself, Federico Rastelli, head of startups at Mamacrowd; Anna Raschi, general manager of Opstart; Davide Fioranelli, founder and general partner of Lumen Ventures; Lorenzo Ferrara, president of Open Seed; Camillo Castellani, co-founder and COO of Fantacycling; and Francesco Cerruti, general manager of Italian Tech Alliance. The impact of the ECSP Regulation on the Italian market was discussed, highlighting how it has eliminated regulatory and communication barriers, expanded opportunities for companies, and strengthened protections for investors, while still requiring further work to bridge regional disparities and promote cross-border collaborations.

“In times like the present, characterised by a complex economic scenario, it is important to have analysis tools such as this report, because they tell of how crowdfunding is now an important tool for raising risk capital that can support the activities of both investors and entrepreneurs, and which can certainly contribute to the growth of the innovation ecosystem and the capital market, providing start-ups with an alternative form of financing. And in the specific case of Equity Crowdfunding, the new European regulation makes the need to provide the clearest possible picture of the phenomenon’s performance and prospects even more central,’ Francesco Cerruti commented in a note.

The full report is available here

ALL RIGHTS RESERVED ©